Silver and Gold Break Out to the Upside, But…

18 May 2024 — Saturday

YESTERDAY in GOLD, SILVER, PLATINUM and PALLADIUM

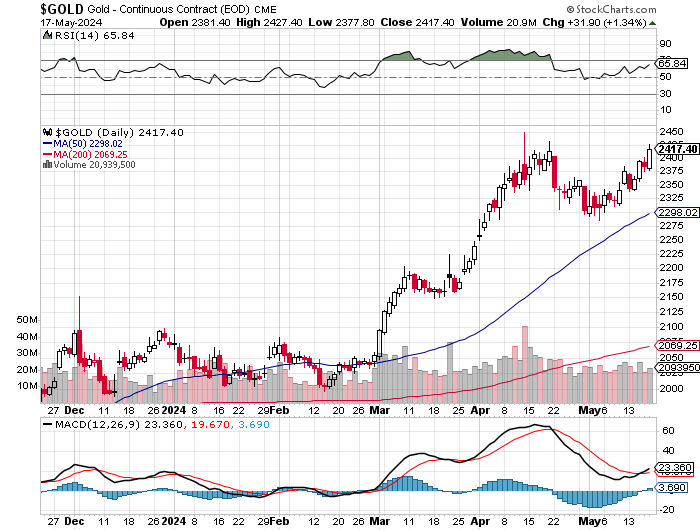

The gold price drifted a bit higher in early Globex trading, but then got smacked down to its low tick of the day minutes before 11 a.m. China Standard Time on their Friday morning. Its quiet rally from there ran into ‘something’ around 8:15 a.m. in London — and from that juncture had a broad and quiet down/up move that lasted until it really took flight at 8:40 a.m. in COMEX trading in New York. But ‘da boyz’ showed up on several occasions to keep its rally in check, with the most obvious intervention coming a couple of minutes after the 11 a.m. EDT London close. It struggled higher from there until around 2:45 p.m. in after-hours trading — and was sold a bit lower going into the 5:00 p.m. EDT close.

The low and high ticks were recorded as $2,377.80 and $2,427.40 in the June contract. The June/August price spread differential at the close in New York yesterday was $23.00… August/October was also $23.00 — and October/December was also $23.00 an ounce.

Gold was closed on Friday afternoon in New York at $2,414.40 spot…up $38.90 on the day — and about 7 dollars off its Kitco-recorded high tick. Net volume was only a bit on the heavier side at a bit over 181,000 contracts — and there were a bit over 37,500 contracts worth of roll-over/ switch volume out of June and into future months…mostly August, but with noticeable amounts into October and December as well.

I saw that 213 gold, plus 118 silver contracts were traded in May yesterday, so we’ll see what this evening’s Daily Delivery and Preliminary Reports show.

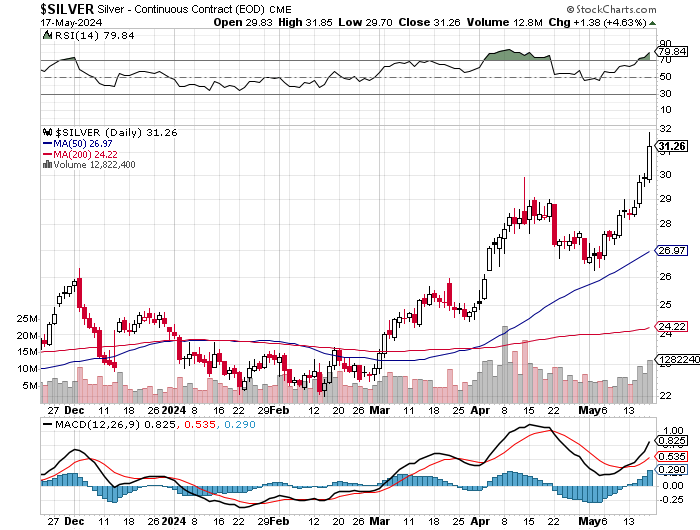

Silver’s price path was almost identical to gold’s, except that after its tamp down minutes after the 11 a.m. EDT London close, it continued to power higher until trading ended at 5:00 p.m. in New York.

The low and high ticks in it were reported by the CME Group as $29.70 and $31.85 in the July contract. The May/July price spread differential in silver at the close in New York yesterday was 21.2 cents…July/September was 31.2 cents — and September/December was 42.1 cents an ounce.

Silver was closed in New York on Friday afternoon at $31.48 spot, up $2.005 from Thursday — and on its absolute high tick for once. Net volume was very monstrous — and much larger than it was on Thursday, at 125,000 contracts — and there were around 9,700 contracts worth of roll-over/switch volume in this precious metal…almost all into September and December, but with a bit into March25 a well.

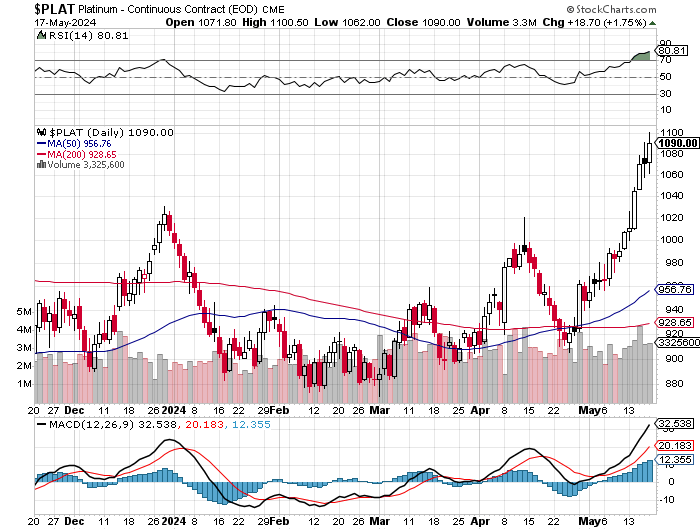

Platinum ticked a bit higher once Globex trading began at 6:00 p.m. in New York on Thursday evening — and then had a very broad and descending down/up/down move that ended when its price also took off higher around 8:40 a.m. in COMEX trading in New York. That rally ran into some ‘difficulties’ along the way — and was finally capped at around 2:50 p.m. in after-hours trading. It was sold a bit lower from there until the market closed at 5:00 p.m. EDT. Platinum was closed at $1,082 spot…up 22 bucks on the day.

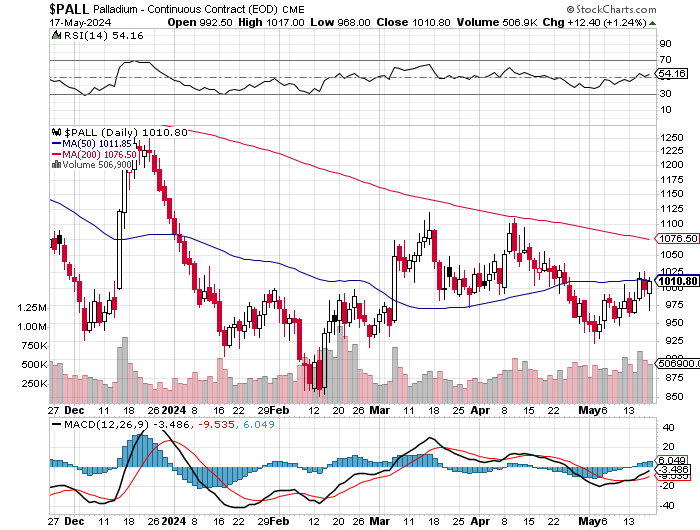

Palladium traded flat to a bit lower until it got hammered starting around 10:35 a.m. China Standard Time on their Friday morning, with its low tick coming around 12:15 p.m. CST. Its very uneven rally from there hit its high tick at 2:50 p.m. in after-hours trading in New York…the same as platinum — and it was also sold a bit lower until the market closed at 5:00 p.m. EDT. Palladium was closed at $996 spot, up 20 dollars from Thursday.

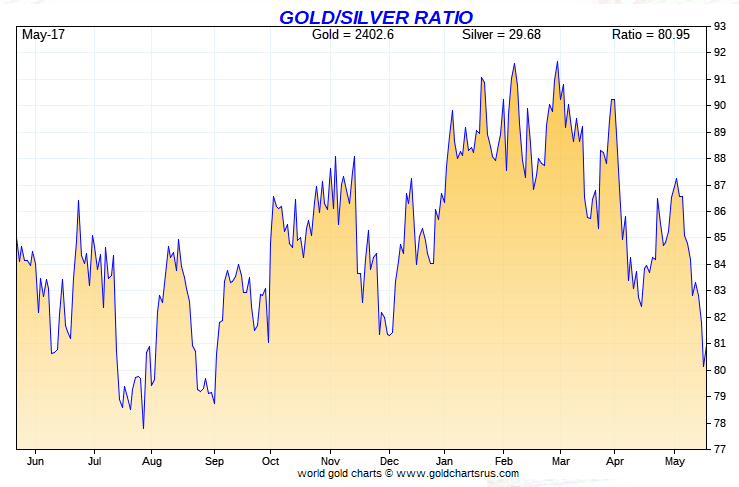

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 76.7 to 1 on Friday…down huge from 80.6 to 1 on Thursday.

Here’s the 1-year Gold/Silver Ratio Chart…courtesy of Nick Laird and, for whatever reason, Friday’s data point is not on it. Click to enlarge.

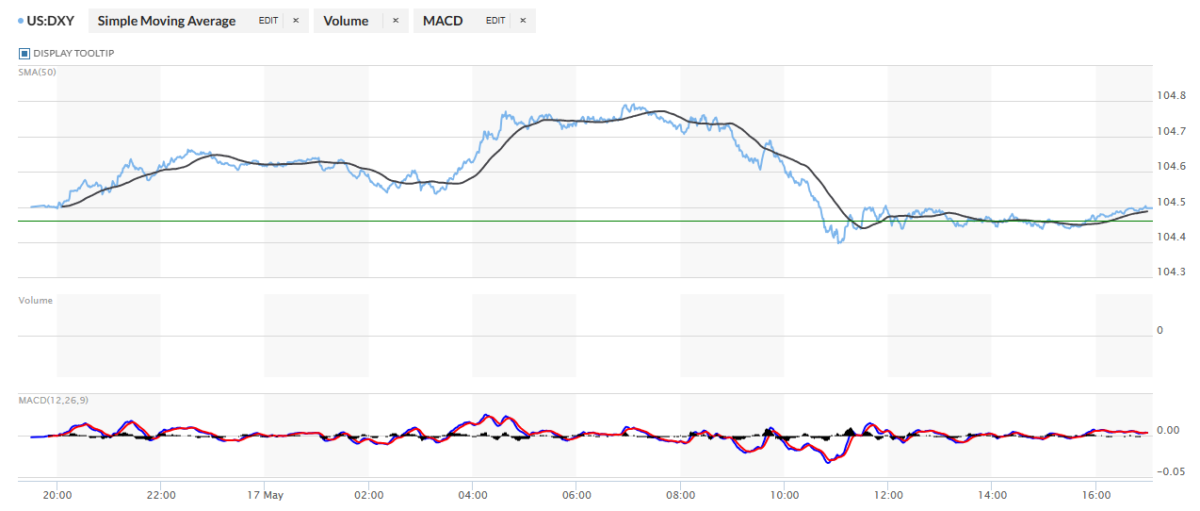

The dollar index closed very late on Thursday afternoon in New York at 104.46 — and then opened higher by 4 basis points once trading commenced at 7:30 p.m. EDT on Thursday evening, which was 7:30 a.m. China Standard Time on their Friday morning. It then traded flat until precisely 8:00 a.m. CST — and then chopped quietly higher until 10:30 a.m. CST. It then wandered quietly lower until 8:18 a.m. in London. From there it had a very broad and descending up/down move that ended at its 11:02 a.m. EDT close…two minutes after London ceased trading — and the moment that both gold and silver got tagged by a bit. That was its low tick — and from that point it wandered very quietly higher until the market closed at 5:00 p.m. EDT.

The dollar index finished the Friday trading session in New York at 104.45…down 1 basis point on the day — and 5 basis points below its indicated close on the DXY chart below.

Here’s the DXY chart for Friday…thanks to marketwatch.com as usual. Click to enlarge.

And here’s the 5-year U.S. dollar index chart that appears in this spot every Saturday, courtesy of stockcharts.com as always. The delta between its close…105.33…and the close on the DXY chart above, was 12 basis points below its spot close. Click to enlarge.

One would have to be very generous to attribute yesterday’s price action in the precious metals, to anything happening with the currencies…as it was all paper trading in the COMEX and Globex futures market — and nothing else. The goings-on in the DXY were used as cover — and even that’s being kind.

U.S. 10-year Treasury: 4.4200%…up 0.0430/(+0.98%)…as of the 1:59 p.m. CDT close

Here’s the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site — which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

Although the Fed was clearly active in the treasury market on Wednesday, the 10-year yield has crept higher since. But looking at the last three or four weeks, it’s certainly obvious that they’re managing its yield lower.

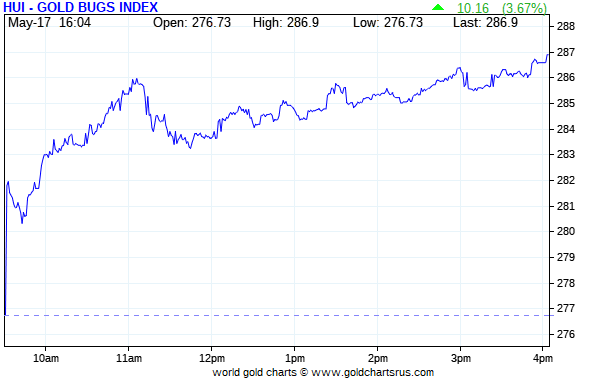

Not surprisingly, the gold stocks gapped up at the 9:30 opens in New York on Friday morning — and that rally continued until minutes after the 11 a.m. EDT London close, when the commercial traders of whatever stripe put in their second appearance in COMEX trading. That tiny sell-off ended at 11:45 a.m. — and from that point the shares rallied quietly until the market closed at 4:00 p.m. EDT. The HUI closed higher by a bit more respectable 3.67 percent.

Not surprisingly, the silver equities did far better, as Nick Laird’s 1-year Silver Sentiment Index closed up 6.64 percent. The last time the silver shares were at this level was in early April of 2022. Click to enlarge.

The three triple-digit gainers yesterday were Coeur and Hecla Mining…along with Endeavour Silver, closing higher by 11.57…11.29 and 10.57 percent respectively. The ‘underperformer’ was Wheaton Precious Metals, as it only closed up only 2.11 percent.

For the second day in a row I didn’t see any company-specific news involving any of the companies in the Silver Sentiment Index.

The reddit.com/Wallstreetsilver website, now under ‘new’ but not improved management, is linked here. The link to two other silver forums are here — and here.

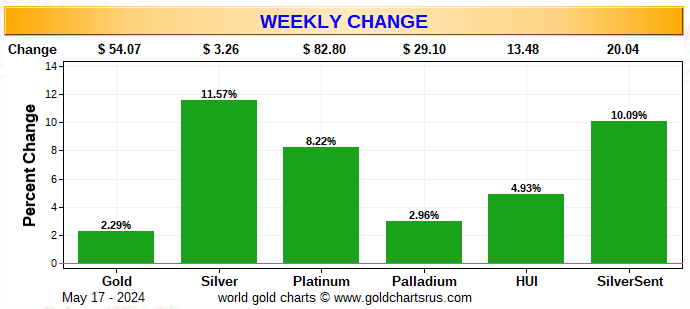

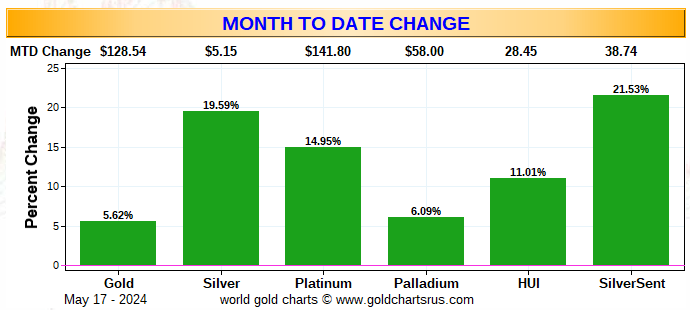

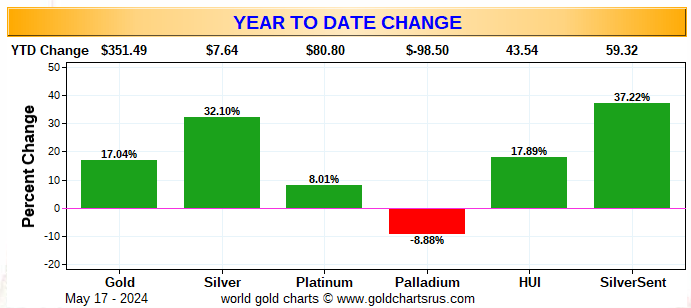

Here are the usual three charts that appear in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the new Silver Sentiment Index.

Here’s the weekly chart — and it’s an impressive wall-to-wall green for the second week in a row. Although the silver equities are outperforming the gold stocks on an absolute basis by a factor of two…on a relative basis, the gold shares are doing better. Click to enlarge.

Here’s the month-to-date chart — and the same can be said about it regarding gold and silver vs. their underlying equities that I just stated about the data in the weekly chart. Click to enlarge.

Here’s the year-to-date chart — with both gold and silver even more solidly in positive territory…unless ‘da boyz’ have more pain in store. With 13 stocks in the Silver Sentiment Index going forward, instead of the old 7…the big loss by SSR Mining earlier this year is now down to a tiny percentage. The underperformance of the precious metal shares is the most evident here…especially the gold stocks. At some point investor interest will return with a vengeance, but exactly when…like I keep saying…is the $64,000 question. However, Friday’s price action was a good start. Click to enlarge.

Of course — and as I mention in this spot every Saturday — and will continue to do so…is that if the silver price was sitting above its all-time $50 high, like gold is currently at its new high as of yesterday…it’s a given that the silver equities would be outperforming their golden cousins by several orders of magnitude.

The CME Daily Delivery Report for Day 14 of May deliveries showed that 210 gold — and 159 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the only one of the four short/issuers in total that mattered was a member of the Big 8 shorts…Wells Fargo Securities…issuing 199 contracts out of its house account. Another member of the Big 8 shorts…BofA Securities…was the only one of the four long/stoppers that mattered, picking up 187 contracts, also for their house account.

In silver, the two short/issuers there were British bank HSBC and ADM, issuing 109 and 50 contracts from their respective client accounts. The three largest of the seven long/stoppers in total were Wells Fargo Securities, JPMorgan and the CME Group…picking up 109, 20 and 13 contracts respectively…JPMorgan for its client account.

The CME Group immediately reissued theirs as 5×13=65 of those one-thousand ounce good delivery bar micro silver futures contracts — and the usual three long/stoppers…Morgan Stanley, Advantage and ADM, picked up 32, 29 and 4 contracts for their respective client accounts.

The link to Friday’s Issuers and Stoppers Report is here.

Month-to-date shows that 2,169 gold, plus 5,918 silver contracts have been issued/reissued and stopped since the May delivery month began. In platinum that number is 119 contracts — and in palladium it’s 6.

The CME Preliminary Report for the Friday trading session showed that gold open interest in May increased by 205 COMEX contracts, leaving 234 still around, minus the 210 contracts mentioned a few paragraphs ago. Thursday’s Daily Delivery Report showed that only 3 gold contracts were posted for delivery on Monday, that means that 205+3=208 more gold contracts were added to May deliveries.

I was surprised to see that June open interest in gold rose by 449 COMEX contracts…normally that number would be show a decrease at this time of month as traders continue to roll out of June and into future months.

Silver o.i. rose by 26 contracts, leaving 228 still open, minus the 159 contracts mentioned a bunch of paragraphs ago. Thursday’s Daily Delivery Report showed that zero silver contracts were posted for delivery on Monday, so that obviously means that 26 more silver contracts were added to the May delivery month.

Total gold open interest on Friday increased by a net 11,178 COMEX contracts — and total silver o.i. rose by a very hefty 12,532 contracts. Both numbers are subject to some minor revisions by the time the CME gets around to posting the final figures on their Internet site later on Monday morning CDT.

Finally and at last there was a very decent deposit into GLD, as an authorized participant added 166,562 troy ounces of gold. There were also 17,842 troy ounces of gold added to GLDM. But the withdrawals continue unabated from SLV…the ninth in a row…as an a.p. removed another 1,005,209 troy ounces of silver.

The volume in SLV was 81% higher than its average daily volume — and in PSLV it was 144% higher. But in GLD it was only 20 percent higher than the average daily volume. It’s a safe bet that all are owed more after yesterday’s price action.

As I mentioned in Thursday’s missive, the cut-of for next Friday’s short report was on Wednesday at the close of business…so none of what happened on Friday will show up in it.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD, GLDM and SLV inventories, there were a net 1,844 troy ounces of gold taken out…but a net 1,435,955 troy ounces of silver were added, with virtually every troy ounce of that amount going into iShares/SVR.

There was no sales report from the U.S. Mint.

Month-to-date they’ve sold what I reported earlier this week…8,000 troy ounces of gold eagles — 5,500 one-ounce 24K gold buffaloes — and 898,000 silver eagles.

For the second day in a row there was no in, out or paper activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday.

There was some activity in silver, as 487,387 troy ounces were received…all of which ended up at Loomis International — and 304,175 troy ounces were shipped out…all of which departed Brink’s, Inc. There was no paper activity — and the link to this is here.

There was also some activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday…all of it at Brink’s, Inc. as usual. They reported receiving 504 of them — and shipped out 500 kilobars. The link to this, in troy ounces, is here.

Turkey/Türkiye finally got around to posting their April gold and silver imports on their website yesterday. It showed that they imported 11.419 tonnes/367,132 troy ounces of gold…plus 46.988 tonnes/1.511 million troy ounces of silver during that month. I have Nick’s charts, but no room for them in today’s column…but Tuesday for sure.

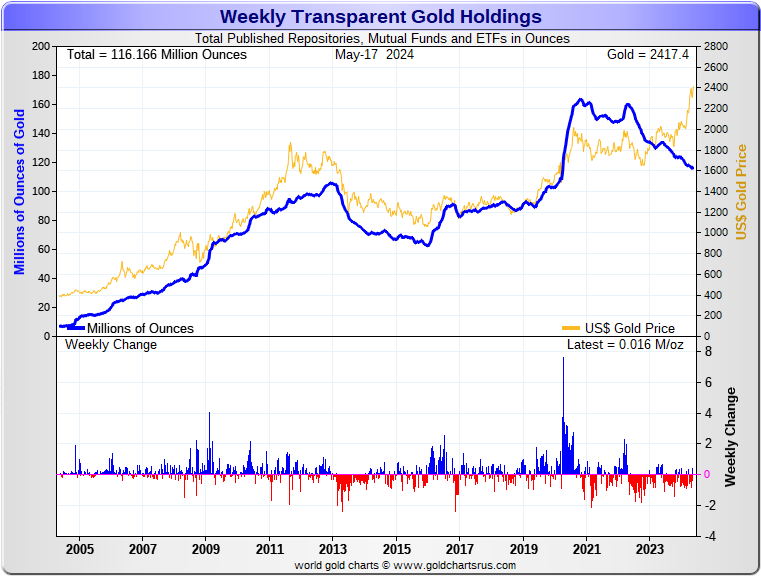

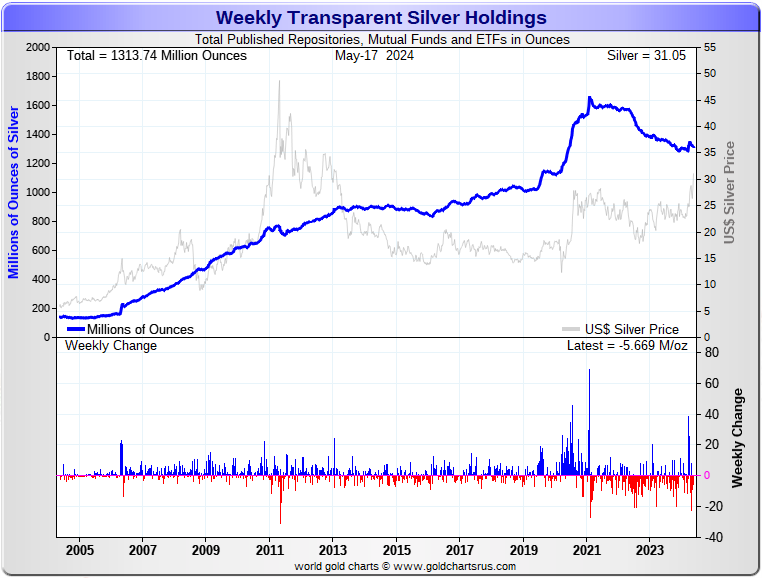

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there were a net and very tiny 16,000 troy ounces of gold added — but a net 5.669 million troy ounces of silver were taken out…almost all to feed the ongoing structural deficit in silver — and almost all from SLV…to feed the continuing structural deficit, I’m sure. Click to enlarge.

According to Nick Laird’s data on his website, there were a net 823,000 troy ounces of gold removed — and a net 19.057 million troy ounces of silver were taken out as well from all the world’s known depositories, mutual funds and ETFs during the last four weeks.

The fact that there have been net withdrawals of these amounts in both gold and silver over the last four weeks during this current big run-up in their prices, shows just how much physical demand for gold there is in London by China. I suspect that all the silver disappearing from Western ETFs and mutual funds for the last while is now in India, plus other Far and Middle East countries…plus feeding the structural deficit in silver as just mentioned a bit further up.

Retail bullion sales have picked up quite a bit this week. Premiums vary. They’re very high at Kitco…but much lower in most other places. That will most likely change if gold and silver continue to power higher from here — and physical shortages return. But we’re a very long way from that at this point.

Then there’s the huge quantities of silver that will be required by all the silver ETFs and mutual funds once institutional buying finally kicks in….which it has yet to do…as there have been nothing but net withdrawals as far as the eye can see. Adding to that demand will be the silver required to cover some or all of the short position in SLV…mentioned in more detail a bit further down.

And as Ted stated very recently, it would appear that JPMorgan has parted with well over 500 million troy ounces of the at least one billion troy ounces that they’d accumulated since 2011.

If they continue in this vein, they are going to have to cough up more ounces to feed this year’s deficit…another 215 million of them according to that latest report from The Silver Institute…plus the almost 120+ million ounces that India has purchased so far this year that we know of.

The physical demand in silver at the wholesale level continues unabated — and that was on display again this week. The amount of silver being physically moved, withdrawn or changing ownership seems to be hitting new heights with each passing week…not to mention all the new contracts being added to the May delivery month.

New silver has to be brought in from other sources [JPMorgan] to meet the ongoing demand for physical metal. This will continue until available supplies are depleted…which will be the moment that JPMorgan & Friends stop selling into the deepening structural deficit.

The vast majority of precious metals being held in these depositories are by those who won’t be selling until the silver price is many multiples of what it is today.

Sprott’s PSLV is the third largest depository of silver on Planet Earth with 170 million troy ounces — and some distance behind the COMEX, where there are 298 million troy ounces being held…minus the silver mentioned in the next paragraph.

It’s now been proven beyond a shadow of a doubt that 103 million troy ounces of that amount in the COMEX is actually held in trust for SLV by JPMorgan according to a letter Ted received from the CFTC some months ago now. That brings JPMorgan’s actual silver warehouse stocks down to around the 27 million troy ounce mark…quite a bit different than the 129.6 million they indicate they have.

But PSLV is still some distance behind SLV, as they are the largest silver depository, with 418 million troy ounces as of Friday’s close…down the 3 million ounces that were withdrawn this past week.

The latest short report from Thursday, May 9 showed that the short position in SLV decreased by a chunky 35.94 percent…from 28.92 million shares sold short…down to 18.52 million shares sold short. BlackRock issued a warning a few years ago to all those short SLV, that there might come a time when there wouldn’t be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it…which is most certainly a U.S. bullion bank, BofA perhaps?

The next short report will be posted on The Wall Street Journal‘s website on Friday, May 24.

Then there’s that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market…with JPMorgan & Friends on the long side. Ted says it hasn’t gone away — and he’s also come to the conclusion that they’re also short around 25 million ounces of gold with these same parties as well. The latest report for the end of Q4/2023 from the OCC came out a bit over a month ago now — and Ted says that very little, if anything, has changed.

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, showed increases in the commercial net short positions in both silver and gold and, as expected, it was far worse in the former.

In silver, the Commercial net short position rose by 7,007 COMEX contracts, or 35.035 million troy ounces of the stuff — and a large chunk of that was Ted’s raptors adding to their short positions.

They arrived at that number by increasing their long position by 2,307 contracts, but also added 9,314 short contracts — and it’s the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, all three categories were buyers during the reporting week. The Managed Money traders increased their net long position by 5,502 COMEX contracts…which they accomplished by adding 5,314 long contracts, but only reduced their short position by 188 contracts. The Other Reportables and Nonreportable/small traders increased their net long positions by 307 and 1,198 contracts respectively.

Doing the math: 5,502 plus 307 plus 1,198 equals 7,007 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver now stands at a knee-wobbling 81,422 COMEX contracts, or 407.11 million troy ounces of silver…up from the 74,415 COMEX contracts/372.08 million troy ounces they were short in last week’s COT Report. I believe this is a record Commercial net short position in silver.

The Big 4 shorts…all bullion banks…did as expected, increasing their net short position by a further 1,528 contracts, up to 50,897 contracts during the reporting week…from the 49,369 contracts they were short in last Friday’s COT Report…a monstrously bearish number. Back on March 7, they were short ‘only’ 31,875 COMEX contracts. However, there was no 8,000 contract Managed Money trader in the Big 8 category at that time.

The Big ‘5 through 8’ shorts also increased their net short position, them by a smallish 331 contracts…from the 23,147 contracts in last week’s report, up to 23,478 contracts in this week’s COT Report. This is a very bearish number for them.

The Big 8 commercial shorts in total increased their overall net short position from 72,516 contracts, up to 74,375 COMEX contracts week-over-week…an increase of 1,859 COMEX contracts.

Ted’s one managed money trader is still there in the Big 8 commercial category — and remains short around 8,000 COMEX contract — and they obviously didn’t do much, if anything, during the reporting week, as the gross short position of the Managed Money traders only fell by 188 contracts.

To make up the difference between the change in the Commercial net short position and what the Big 8 shorts did, Ted’s raptors, the small commercial traders other than the Big 8, went even further onto the short side…adding a bit more than 5,000 contracts.

Looking at this week’s data, that lone Managed Money trader appears to be the largest of the Big ‘5 through 8’ category, which leaves Ted’s raptors net short 11,000+ COMEX contracts — and still a record amount.

And I’m still taken aback by the fact that this group of traders is this short — and I’ll have more on this in a bit.

So it was mostly because of Ted’s raptors going further short that caused the increase in the Commercial net short position this week, but that means nothing when all the commercial traders are net short.

Here’s Nick’s 3-year COT chart for silver, updated with the above data. Click to enlarge.

Of course — and it pains me to say this, but yesterday’s COT Report is very much ‘yesterday’s news’ because of the price action since the cut-off on Tuesday. Although there may have been short covering yesterday by some…it’s more than obvious from Friday’s price action in silver that the Big 4 shorts…which is most likely down to the Big 1 or 2 shorts…are still out and about.

And about that record raptor short position, I suspect that a small handful of them may remain long silver by tiny amounts, or are completely out of the market. But the Big shorts have now expanded from the Big 8…to maybe the Big 12 or Big 15. So to call them ‘raptors’ now is a bit of a misnomer.

And as I pointed out in this space last week — and the week before…”there’s never been such an outright bearish COMEX futures market set-up like this in silver. The jury is still very much out on whether the collusive commercial traders of whatever stripe will be able to flush out the silver market/managed money traders to the downside like they’ve always done in the past.” The only other option is that collusive commercial shorts get overrun. Nothing has changed in that regard — and the latter prospect looms larger than ever now.

But if such an engineered price decline does occur, the Big 8 commercial shorts will be in direct and fierce competition from Ted’s raptors for the long positions being puked up by the managed money traders et al. This is a situation that has occurred before in the distant past, but never to this degree. As you already know, his raptors hold a record short position — and will certainly be aggressive buyers during any engineered price decline.

But the drumbeat of that structural deficit in silver hasn’t gone away — and won’t for a very long time, regardless of what the final price of silver turns out to be when the dust has settled.

In gold, the commercial net short position rose by a modest 4,844 COMEX contracts, or 484,400 troy ounces of the stuff.

They arrived at that number by increasing their long position by 8,684 contracts, but also added 13,528 short contracts. Like in silver, it’s the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was almost all Managed Money traders, as they increased their net long position by 4,336 COMEX contracts…which they accomplished by adding 7,088 long contracts, but also increased their short position by 2,752 contracts. It’s the difference between those two numbers that represents their change for the reporting week.

The Other Reportables increased their net long position as well…by a scant 593 contracts, while the Nonreportable/small traders decreased their net long position by a minuscule 85 COMEX contracts.

Doing the math: 4,336 plus 593 minus 85 equals 4,844 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold now sits at 232,110 COMEX contracts/23.211 million troy ounces of the stuff…up those 4,844 contracts…from the 227,266 COMEX contracts/22.727 million troy ounces they were short in the May 10 COT Report.

The Big 4 shorts increased their net short position by 2,092 COMEX contracts…from 161,069 contracts, up to 163,161 contracts…which is a hugely bearish number — and the most bearish since December 8 of last year.

The Big ‘5 through 8’ shorts also increased their net short, them by a smallish amount…from the 71,528 contracts they held short in the May 10 COT Report, up to 72,516 contracts held short in the current COT Report…a very long way from a bullish number — and an increase of 1,162 COMEX contracts week-over-week.

The Big 8 short position increased from 232,597 contracts/23.260 million troy ounces, up to 235,851 contracts/23.585 million troy ounces…an increase of 3,254 COMEX contracts.

Ted’s raptors, the small commercial traders other than the Big 8 shorts, were sellers during the reporting week, decreasing their net long position from 5,331 COMEX contracts — down to 3,741 COMEX contracts…a drop of 1,590 contracts.

Don’t forget that despite their small size, the raptors are still commercial traders in the commercial category. It was their sale of long contracts that had the mathematical effect of increasing the commercial net short position, which really isn’t an increase at all.. Remember, it’s only what the Big 4/8 shorts do that matters.

Here’s Nick Laird’s 3-year COT Report chart for gold, updated with the above data. Click to enlarge.

I was expecting only a smallish increase at most in the commercial net short position in gold in yesterday’s COT Report — and that’s what we got.

And, like for silver, this COT Report in gold is also very much ‘yesterday’s news’ — and as bearish as this one was…next week’s report will be even more butt-ass ugly…unless ‘da boyz’ show up in force between now and the cut-off next Tuesday.

Of course the unbooked/unrealized margin call losses by the short holders in gold and silver is now most likely past the $30 billion mark — and on top of that is the unrealized $30-odd billion loss that BofA has on its books in that OTC transaction involving JPMorgan from several years back.

We may have seen some short covering yesterday, but if there was any, it was only by smaller traders — and the commercial traders went short against them for every long contract they bought.

These are most desperate times for all shorts — and it’s a given that the CME Group and the CFTC, plus others…are more than aware of it. How they react to this, remains unknown. I’ll have more on this in The Wrap.

In the other metals, the Managed Money traders in palladium, increased their net short position by a scant 81 COMEX contracts — and are net short palladium by an eye-watering 11,894 contracts…43.4 percent of total open interest. All of the other four categories in the Disaggregated COT Report are now net long palladium…the Swap Dealers in the commercial category in particular.

In platinum, the Managed Money traders increased their net long position by a very hefty 12,349 contracts during the reporting week — and are now net long platinum by 16,535 contracts. The traders in the Producer/Merchant category are mega net short 27,968 COMEX contracts — and now even the Swap Dealers in the commercial category are net short platinum for the first time that I can remember…but only a piddling 226 COMEX contracts. The traders in both the Other Reportables and Nonreportable/small traders categories remain net long platinum by very decent amounts…especially the Other Reportables.

It’s the world’s banks — and mostly U.S. banks in the Producer/Merchant category that are ‘The Big Shorts’ in platinum, as per last Friday’s Bank Participation Report.

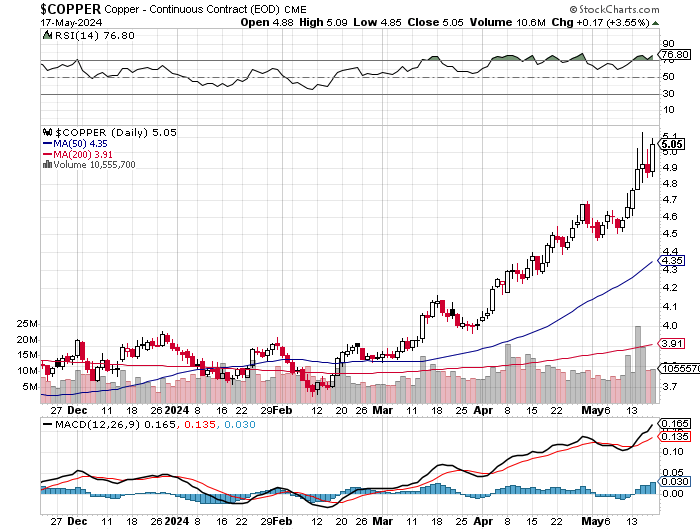

In copper, the Managed Money traders increased their net long position by a further 7,374 COMEX contracts — and are now net long copper by 69,225 COMEX contracts…about 1.731 Billion pounds of the stuff as of yesterday’s COT Report…up from the 1.546 Billion pounds they were net long copper in last week’s report.

Copper, like platinum, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 91,150 copper contracts/2.279 Billion pounds — while the Swap Dealers are net long 21,494 COMEX contracts/537 million pounds of the stuff.

Whether this means anything or not, will only be known in the fullness of time. Ted says it doesn’t mean anything as far as he’s concerned, as they’re all commercial traders in the commercial category. However, this bifurcation has been in place for as many years as I can remember — and that’s a lot.

In this vital industrial commodity, the world’s banks…both U.S. and foreign…are net long 8.7 percent of the total open interest in copper in the COMEX futures market as shown in the May Bank Participation Report that came out a week ago…down from the 10.7 percent they were net long in April’s. At the moment it’s the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are net short copper in the Producer/Merchant category, as the Swap Dealers are mega net long, as pointed out above.

The next Bank Participation Report is due out on Friday, June 7.

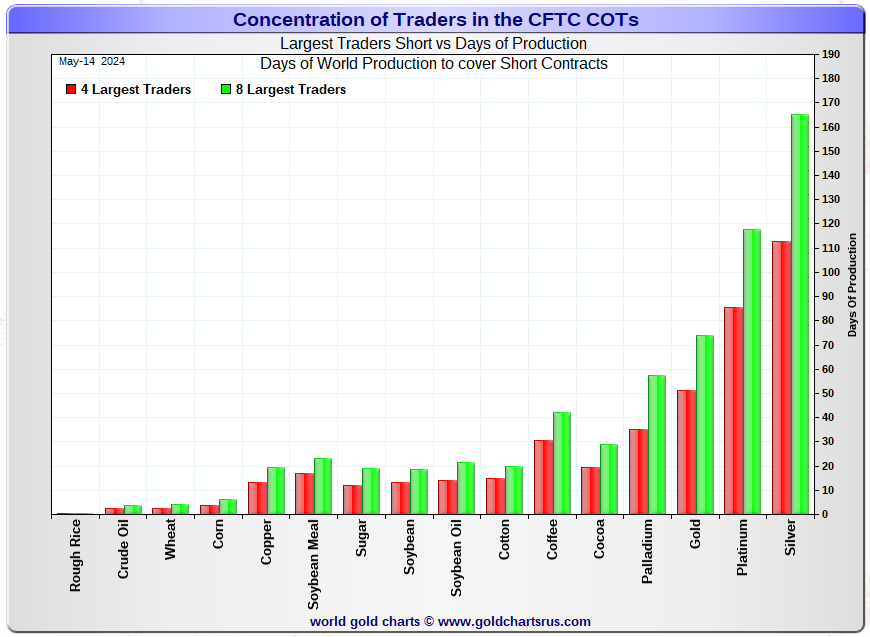

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, May 14. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big ‘5 through 8’ traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week’s data, the Big 4 traders are short about 113 days of world silver production…up about 3 days from last week’s report. The ‘5 through 8’ large traders are short an additional 52 days of world silver production…up 1 day from last week, for a total of about 165 days that the Big 8 are short — and up 4 days from last week’s report.

Those 165 days that the Big 8 traders are short, represents 5.5 months of world silver production, or 371.88 million troy ounces/74,375 COMEX contracts of paper silver held short by these eight mostly commercial traders. Several of the largest of these are now non-banking entities, as per Ted’s discovery a year or so ago. May’s Bank Participation Report that came out last week continues to confirm that this is still the case — and not just in silver, either.

The small commercial traders other than the Big 8 commercial shorts…are short something north of 11,000 COMEX contracts…once that Managed Money trader holding 8,000 contract short position the Big ‘5 through 8’ category is factored out.

But that short position has to be bought back at some point…as does the 8,000 contracts short position held by that lone managed money trader that currently [and temporarily] inhabits the Big 8 short category. Whether they cover for a profit on a future ‘wash, rinse & spin’ cycle, or are forced to cover in a panic, booking big losses on rising prices, is still an unknown…but the latter scenario now looms large.

In gold, the Big 4 are short about 51 days of world gold production…unchanged from last week’s COT Report. The ‘5 through 8’ are short an additional 23 days of world production, up 1 day from last week…for a total of 74 days of world gold production held short by the Big 8 — and obviously up 1 day from last Friday’s COT Report.

The Big 8 commercial traders are short 43.4 percent of the entire open interest in silver in the COMEX futures market as of yesterday’s COT Report, up from the 44.8 percent that they were short in the May 10 COT Report — and something around the 50 percent mark once their market-neutral spread trades are subtracted out. That percentage drop was because of a fairly big increase in silver’s total open interest during the week, which affects the calculation.

In gold, it’s 45.1 percent of the total COMEX open interest that the Big 8 are short, up a bit [for the second week in a row] from the 43.9 percent they were short in the May 10 COT Report — and a bit over the 50 percent mark once their market-neutral spread trades are subtracted out.

Ted is still of the opinion that Bank of America is short about one billion ounces of silver in the OTC market, courtesy of JPMorgan & Friends. He’s also of the opinion that they’re short 25 million ounces of gold as well. And with the latest report from the OCC in hand from about two months ago, he’s still of that mind.

As reported further up, the short position in SLV now sits at 18.52 million shares as of Thursday’s short report…down a hefty 35.94% from the 28.92 million shares sold short in the prior report. The next short report is due out on Friday, May 24. I suspect its far worse as of yesterday’s close.

The situation regarding the Big 4/8 commercial short position in gold and silver remains obscene and hugely bearish. Both became even more so in yesterday’s COT Report…as the Big 4/8 increased their short position in both.

As Ted has been pointing out ad nauseam, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward — which should be totally obvious to all by now, but most remain oblivious to that fact — and if they are aware of it, are careful never to mention it in the public domain.

I don’t have all that many stories, articles or videos for you today…but that ones I do have are all definitely worth your while.

CRITICAL READS

We are all zombies now — Alasdair Macleod

For decades, all G7 nations and more besides have prevented the creative destruction upon which economic progress depends. Whole countries are now zombified.

The consequence is soaring, unproductive debt both in public and private sectors. In the past, debt levels have been low enough for central banks to force through further interest rate suppression to perpetuate malinvestments. That is no longer possible, with G7 government debt to GDP ratios commonly exceeding 100%. This article argues that interest rates will not fall materially, if at all, but will continue to rise.

Rising interest rates threaten to destroy the stagnating businesses which make up most of G7 economies, threatening entire banking systems. As their power has increased, central banks now bear responsibility for the financial integrity of the business environment as well. Individual insolvencies may be tolerated, but the prospect of wholesale failures requires governments and their central banks to prevent them.

Consequently, Schumpeter’s concept of creative destruction has not been permitted to work its magic, and without which capitalism fails to deliver economic progress. We are usually aware of the economic progress arising from new technologies because it is plain to see. But we are less aware of the need of more mundane processes to continually evolve. In free markets this is achieved by competition among suppliers to improve products and services for the consumer.

It follows that a Darwinian process of natural evolution must occur, whereby those businesses not fit to survive competition must die, and their capital and labour resources redeployed towards production that is viable and capable of anticipating ever-changing patterns of consumption.

This commentary from Alasdair is definitely worth reading — and I thank Chris Powell for pointing it out. Another link to it is here.

Zhang Zhan — Doug Noland

From a historical perspective, there is a significant probability of an inflationary resurgence. And what is a reasonable probability of a major geopolitical development triggering an inflationary shock? Some might argue 10 to 20%. Closely monitoring troubling global developments – including this week – I would place the odds at greater than 50% (and growing).

Markets see excessively loose conditions and increasingly powerful inflationary dynamics. The Bloomberg Commodities Index surged 2.9% this week, boosting y-t-d gains to 7.2%. From Bloomberg: “The Bloomberg Commodities Index is on pace for a third straight monthly gain, a streak last seen in 2022 when core inflation was running above 8%. The commodity index is up almost 4% in May, on pace for the best month since July.”

Gold surpassed $2,400 for the first time in Friday trading, ending the week at $2,414 with a 17.1% y-t-d gain. Silver surged 11.7% this week to $31.493 – up 29.8% y-t-d to the high back to February 2013. Platinum gained 8.8%. Copper jumped 8.3%, pushing 2024 gains to 30%. Nickel gained 11.2% this week, Lead 2.7%, Tin 6.7%, Palladium 3.3%, and Aluminum 3.3%. Crude futures rose 2.3%, gasoline 3.0%, and natural gas 16.6%. Lumber gained 7.5%, Cattle 2.8%, Coffee 1.8%, Soybeans 1.9%, and Rubber 3.7%.

What is the probability that surging commodities prices foreshadow the next round of inflationary pressures? It’s certainly not very low. With the Fed refusing to tighten conditions, how will this sit with the bond market?

Doug’s weekly market copy is always worth reading — and this one is no exception. This iteration put in an appearance on his website shortly before midnight PDT on Friday — and another link to it is here. Gregory Mannarino‘s post market close rant for Friday is linked here — and runs for 17 minutes.

David Stockman on Why Washington D.C. is the War Capital of the World

Ultimately, there is no mystery as to why the Forever Wars go on endlessly. Or why at a time when Uncle Sam is hemorrhaging red ink a large bipartisan majority saw fit to authorize $95 billion of foreign aid boondoggles that do absolutely nothing for America’s homeland security.

To wit, Washington has morphed into a freak of world history—a planetary War Capital dominated by a panoptic complex of arms merchants, paladins of foreign intervention and adventure and Warfare State nomenklatura. Never before has there been assembled and concentrated under a single state authority a hegemonic force possessing such unprecedented levels of economic resources, advanced technology and military wherewithal.

Not surprisingly, the world’s War Capital is Orwellian to the core. Its endless pursuit of war is always and everywhere described as the promotion of peace. Its jackboot of global hegemony is gussied-up in the form of alliances and treaties ostensibly designed to promote a “rules-based order” and collective security for the benefit of mankind, not simply the proper goals of peace, liberty, safety and prosperity within America’s homeland.

Unfortunately, the whole intellectual foundation of the enterprise is false. The planet is not crawling with all-powerful would-be aggressors and empire-builders who must be stopped cold at their own borders, lest they devour the freedom of all their neighbors near and far.

This very worthwhile commentary from David appeared on the internationalman.com Internet site on Friday — and another link to it is here.

Putin & Xi, preparing for big sanctions war — Alex Christoforou and Alexander Mercouris…with special guest Alex Krainer

This very long, but very worthwhile and important video runs for 1 hour 24 minutes. The interview/discussion lasts for 49 minutes — but the Q&A session after that involves Krainer is definitely worth your while as well. I’d never heard of this guy before, but he has to be one of the sharpest tacks I’ve ever run across. I thank reader Guido Tricot for pointing it out — and another link to it is here.

Gold will rise despite its miners, but who will be allowed to profit? — Chris Powell

Remarks by Chris Powell

Secretary/Treasurer, Gold Anti-Trust Action Committee Inc.

Mining Investment Asia Conference

Marriott Tang Plaza Hotel, Singapore

Thursday, May 16, 2024

For 25 years my organization, the Gold Anti-Trust Action Committee Inc., has been trying to persuade the monetary metals mining industry, financial news organizations, and investors of a truism: that central banks and governments, especially in the West and the United States, intervene in the gold market not just openly once in a great while but also surreptitiously and frequently to support their currencies against gold.

Despite the overwhelming documentation of this truism, GATA has had only limited success. Ironically, we have been least successful with the monetary metals mining industry itself, which has had the most to gain from wider recognition of the frequent intervention against its products.

Much of the documentation of this intervention is found in the archives and on the internet sites of central banks and governments themselves. Among my favorite confessions of intervention is the address given by William R. White, head of the monetary and economic department of the Bank for International Settlements, the central bank of the central banks, at a conference held at the bank in Basel, Switzerland, in July 2005.

White’s address was titled “The Past and Future of Central Bank Cooperation.” His audience included dozens of central bank officials and academics from around the world. White described what he said were four primary objectives of central bank cooperation. The fourth objective, White said, was “the provision of international credits and joint efforts to influence asset prices (especially gold and foreign exchange) in circumstances where this might be thought useful”

This long and chart filled presentation from Chris that he delivered in Singapore on Thursday is certainly worth your while considering the price action in the precious metals these days — and another link to it is here.

QUOTE of the DAY

The WRAP

“Understand this. Things are now in motion that cannot be undone.” — Gandalf the White

Today’s pop ‘blasts from the past’ are in memory of John Barbata…the veteran rock drummer for both The Turtles and Jefferson Starship…who passed away this week at the young age of 79 years. The first tune from 1967…when he was with The Turtles…should be instantly recognizable — and is linked here. The second song from The Definitive Concert in Vancouver, B.C. in 1983, which should also be instantly recognizable, is from his time with Grace Slick and Mickey Thomas at Jefferson Starship — and that’s linked here. There’s a bass cover to the latter tune — and it’s amazing. That’s linked here.

Today’s classical ‘blast from the past’ dates from 1868. It was written by Norway’s most famous composer…Edvard Grieg — and is his Piano Concerto in A minor, Op. 16. He was only 24-years young when he composed it. To this day it remains his most popular work — and beloved by concert-goers the world over…this writer included.

Here’s Georgian-born concert pianist Khatia Buniatishvili at the keyboard — and Maestro Tugan Sokhiev conducts the Orchestre National du Capitole de Toulouse. The link is here.

Gold finally closed above $2,400 spot — and at a new nominal all-time high for it…but not in inflation-adjusted/currency debasement terms…far from it. I was more than surprised that volume was as low as it was — and that it still has some ways to go before being ‘overbought’ on its RSI trace.

Of course silver was the star once again…blowing through $30 spot like the proverbial hot knife through soft butter. It’s hugely overbought once more — and Friday’s enormous volume was even heavier than it was on Thursday.

Silver closed on its high tick in the spot market, but a hefty 59 cents off its high tick in its current front month, which is July.

Platinum’s big rally continues unabated. It made it to $1,100.50 in its current front month at its high tick on Friday, but was hauled down and closed ten bucks below that price. Palladium’s rally took it back to within a dollar of its 50-day moving average.

Copper finally closed above five bucks in its current front month. It finished the Friday trading session at $5.05/pound — and up a hefty 17 cents.

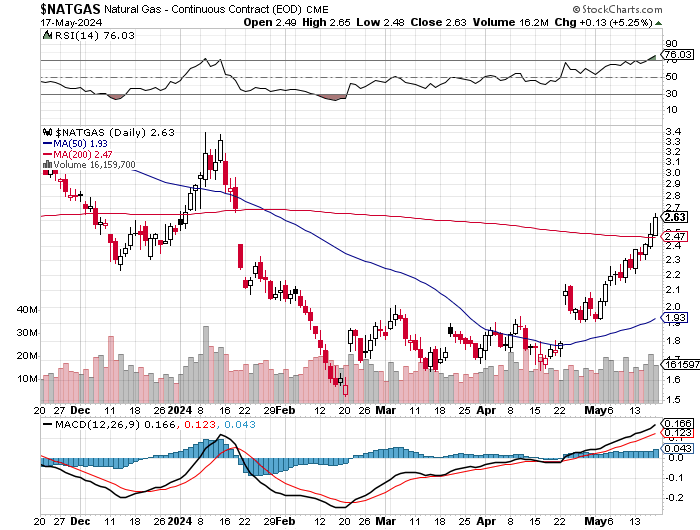

Natural gas [chart included] continues to claw its way higher. It finished the day up 13 cents at $2.63/1,000 cubic feet — and after three days of gains, is back above its 200-day moving average by a respectable amount. It’s also well into overbought territory on its RSI trace.

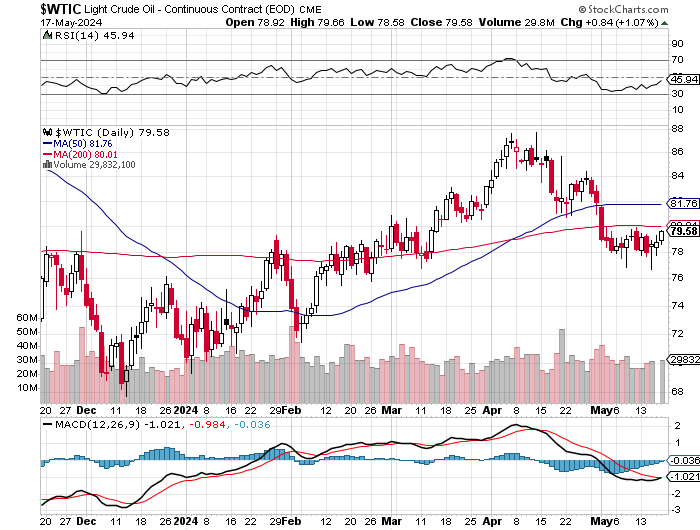

WTIC picked up its third tiny gain in a row as well, as it finished the day at $79.58/barrel…up another 84 cents…but still below any moving average that matters by a bit.

Here are the 6-month charts for the Big 6+1 commodities…courtesy of stockcharts.com as always and, if interested, their COMEX closing prices in their current front months on Friday should be noted. Click to enlarge.

Like you, I was more than relieved that silver finally blew through 30 bucks — and gold closed above $2,400. Their associated equities did well…especially the silver stocks, which wasn’t all that surprising.

But under the surface, the commercial traders of whatever stripe remain out and about — and that was more than obvious from the Kitco charts at the top of today’s column. One would have to suspect that there was some short covering going on in the four precious metals, plus copper yesterday…but it certainly wasn’t ‘da boyz’.

If a COT Report was available at the close of COMEX trading on Friday, it would undoubtedly show that the Big 4/8 commercial traders continued to add to their short positions…as their respective total open interests blew out by a lot yesterday. Its hard to put in words just how extreme the bearish structures are in both gold and silver now…especially in the latter.

And while on the subject of short positions, it’s a given that the unrealized/unbooked margin call losses by all those short gold and silver at the moment are now well in excess of $30 billion in the COMEX futures market — and that doesn’t include the $30+ billion that BofA is short in the OTC market…which is over and above that amount, according to Ted.

If this continues, BofA could have its own Bear Stearns moment at some point…although its stock closed unchanged on the day yesterday. As Ted pointed out a couple of years ago, it was the $2 billion margin call in both gold and silver that they couldn’t meet that sank them back in 2008…as they were ‘the big short’ at the time. That’s chicken feed compared to what BofA is short in the OTC market — and that doesn’t include whatever short positions they also hold in the COMEX futures market.

Of course Bear Stearns was a brokerage house — and not a ‘too big to fail’ bullion bank as Bank of American is, so it may get bailed out…or not.

Starting with nickel on the LME several years ago now…then cocoa a week or so ago — and now copper and the four precious metals, these rallies are certain to have short holders, both large and small, in a world of financial pain…which got much worse yesterday.

Ted has been surprised that there hasn’t been more short covering than there has been to date. But whatever longs these smaller shorts have bought to cover their short positions so far…the short side of those trades have been gobbled up by the Big 8 commercial shorts, so nothing has changed from a COT perspective…although prices are obviously higher.

And as he’s been pointing out for more than a decade now…”the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward“. That was true back then — and even more so today.

These big shorts continue to double down in an attempt to hold their ground — and maybe turn the tide at some point. However, as I’ve stated before, the ‘ground’ is now shifting beneath their feet — and that movement is to the East.

It’s impossible to overstate how dangerous this has become for both the LME and the COMEX — and those that are short…especially the large commercial traders. To say they are in desperate straits at the moment would be kind. Desperate times may call for desperate measures… bordering on draconian. So unless an engineered price decline of Biblical proportions can be arranged in all four, plus copper — and soon, the strong possibility now exists that a short covering rally of Biblical proportions is not far off.

Most shorts will burn as Ted laid out in his prescient essay headlined “The Bonfire of the Silver Shorts“…so I still don’t rule out the possibility that the COMEX will be forced to close at some point in order to save them — and ward off the financial debacle that is sure to follow.

But one way or another, this 50+ year price management scheme in the precious metals in particular — and the rest of the commodities complex in general, is about to breath its last in the not-too-distant future.

Like Hemingway’s description of bankruptcy…”slowly, at first…then suddenly“…the “suddenly” part now feels imminent.

I await the 6:00 p.m. Globex open in New York on Sunday evening with some interest.

And as I sit here wearing my Triple-Digit Silver T-shirt from First Majestic Silver….I’m still ‘all in’ –and will remain so to whatever end…but ever mindful of ‘The Great Taking‘.

I’m done for the day — and the week — and I’ll see you here on Tuesday.

Ed